Tractor sales in the first half of 2025 decreased by 38 year on year with the top five companies accounting for nearly 70 of the market share

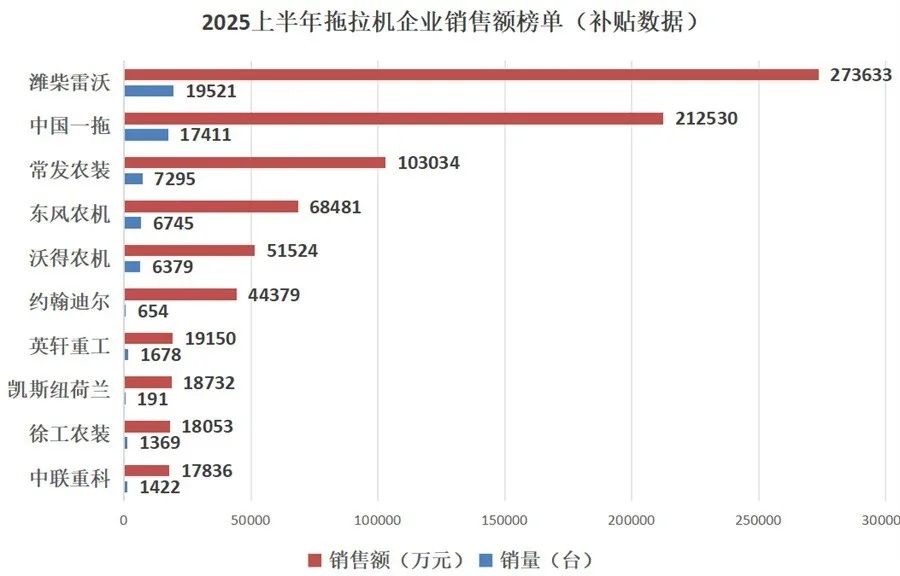

In the first half of 2025, the Chinese tractor industry will enter a period of deep adjustment under multiple pressures. On the one hand, market demand is suppressed by factors such as low grain prices and overcapacity, and the industry as a whole is showing a weak trend of "not thriving during peak seasons"; On the other hand, policy driven and technological iteration are reshaping the logic of industrial competition, with intelligence, new energy, and high-end becoming key breakthroughs. According to the latest publicly available data on agricultural machinery purchase subsidies, industry concentration continues to increase, with top enterprises stabilizing their positions through economies of scale and technological advantages, while small and medium-sized enterprises seek breakthroughs in differentiated competition.According to publicly available data on agricultural machinery purchase subsidies, the sales volume of tractors in the first half of 2025 exceeded 90000 units, with a sales revenue of around 10.43 billion yuan, a year-on-year decrease of 38%. Among them, there are a total of 3 enterprises with tractor sales exceeding 1 billion yuan, a decrease of 1 compared to the same period last year; There are a total of 14 enterprises with over 100 million yuan, a decrease of 8 compared to the same period last year. The top five companies in terms of sales have a market share of nearly 70%.

Among them, Weichai Lovol became the dual champion of tractor sales and sales in the first half of 2025 with a total sales volume of 2.74 billion yuan and a sales volume of 19521 tractors, with a market share of over 26%. As a leading enterprise in the agricultural machinery industry, Weichai Lovol has seized the market in recent years with high-end products such as power shifting and intelligence. Its main selling model is the Lovol M2004-5RP power shift tractor, with a unit price of around 260000 yuan, significantly higher than the industry average price.

Relying on the background of state-owned enterprises and the historical accumulation of the "Dongfanghong" brand, China Yituo sold a total of 17411 tractors in the first half of 2025, with a sales revenue of 2.13 billion yuan and a market share of 20.4%, becoming the runner up in tractor sales and sales revenue in the first half of 2025. According to publicly available subsidy data, the main selling models of China Yituo are small and medium horsepower tractors in the 504-1204 range, and there is still room for improvement in sales of high horsepower tractors.

The third, fourth, and fifth places on the list of tractor sales and sales revenue in the first half of 2025 are all Jiangsu enterprises, namely Changfa Agricultural Equipment, with sales of 7295 units and sales revenue of 1.03 billion yuan; Dongfeng Agricultural Machinery, with a sales volume of 6745 units and a sales revenue of 680 million yuan; Wode Agricultural Machinery sold 6379 units with a sales revenue of 520 million yuan. In recent years, Changfa Agricultural Equipment has also focused on high-power tractors. Its main selling model, CFJ2204 tractor, has sold 1383 units, with sales exceeding 360 million yuan, second only to the Lovol M2004-5RP power shift tractor. However, Dongfeng Agricultural Machinery and Wode Agricultural Machinery still mainly sell small and medium-sized tractors with 120 horsepower or less.

In the statistics of the tractor market data for the first half of 2025, John Deere and CNOOC Netherlands sold 654 and 191 tractors respectively at high prices of 440 million yuan and 190 million yuan, with an average unit price of 680000 yuan and 980000 yuan, which is six or seven times higher than the average tractor price of leading domestic enterprises such as Weichai Lovol and China First Tractor. It can be seen that in the field of high-end high-power tractors, international agricultural machinery giants such as John Deere and Case New Holland are still far ahead.

Among the top ten companies in terms of tractor market share in the first half of 2025, there are also three companies that have crossed over from the construction machinery industry. According to the ranking of tractor sales, they are Yingxuan Heavy Industry, ranked seventh, XCMG Agricultural Equipment, ranked ninth, and Zoomlion Heavy Industry, ranked tenth. Undoubtedly, Zoomlion was the earliest among these three companies to enter the field of agricultural machinery, and its development is also the most comprehensive. Its agricultural machinery product categories reach more than ten, and it ranks high in multiple sub sectors. In the five or six years since entering the agricultural machinery industry, XCMG has made rapid progress in the tractor field and has become the only company on the list that has not declined compared to last year.

Overall, in the first half of 2025, the Chinese tractor industry underwent profound structural adjustments and market reshuffling. Faced with multiple challenges such as weak market demand and intensified competition, leading enterprises have solidified their market position through technological upgrades, product intelligence, and high-end strategies, while small and medium-sized enterprises are seeking differentiated survival strategies. From the sales data, it can be seen that the industry concentration has further increased, and market resources are gradually gathering towards a few leading enterprises.

With the continuous deepening of national support policies for agricultural modernization and the promotion of technological progress, the Chinese tractor industry is expected to usher in new development opportunities. How to better utilize technological innovation and optimize industrial structure will be a question that every practitioner needs to consider. At the same time, competition in both domestic and international markets will become more intense. For all participants, seizing opportunities and responding to challenges is essential in order to stand undefeated in the future market.